Managing money effectively is a cornerstone of a stable and fulfilling life. This is where personal finance comes into play. In this article, we’ll explore the meaning of personal finance, its various components, its importance, and how a personal financial advisor can guide you toward financial success.

What Is Personal Finance?

Personal finance refers to the management of an individual’s financial activities, such as budgeting, saving, investing, and planning for retirement. It encompasses all aspects of financial decision-making and aims to achieve personal financial goals.

Key aspects of personal finance include:

- Income Management: Tracking earnings from salaries, businesses, or investments.

- Expenses: Controlling daily expenses and avoiding unnecessary debt.

- Savings and Investments: Allocating funds for emergencies and long-term growth.

- Retirement Planning: Ensuring financial security in your golden years.

By understanding personal finance, you can create a sustainable plan to manage your money efficiently and achieve financial freedom.

Why Is Personal Finance Important?

Personal finance is crucial for building a stable and prosperous future. Here’s why it matters:

1. Achieving Financial Goals

Whether it’s buying a home, starting a business, or funding your child’s education, personal finance provides a roadmap to achieve these milestones.

2. Building Emergency Funds

Life is unpredictable, and unexpected expenses can arise. A well-managed personal finance strategy ensures you’re prepared for emergencies, reducing financial stress.

3. Reducing Debt

Effective budgeting and financial planning help you avoid excessive borrowing and manage existing debt responsibly.

4. Securing Retirement

Proper retirement planning ensures you can maintain your financial lifestyle even after you stop working. This includes contributions to pensions or investments.

5. Improving Financial Literacy

Understanding personal finance empowers you to make informed decisions about credit cards, loans, and investments.

The Role of a Personal Financial Advisor

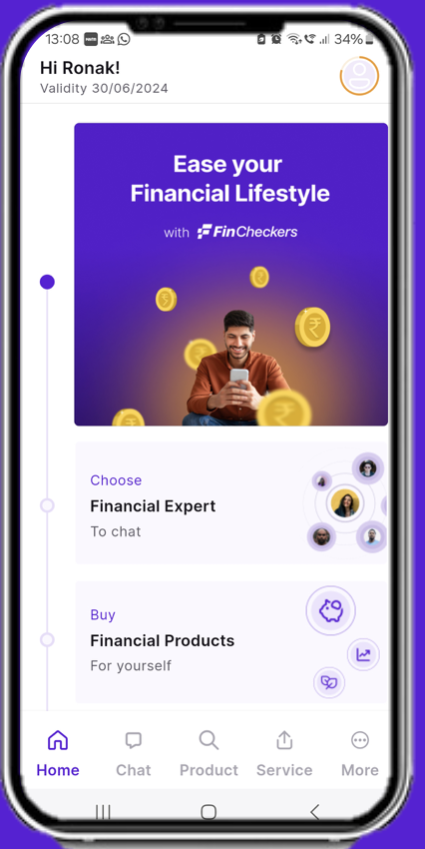

A personal financial advisor is a professional who provides tailored advice on managing your finances. Their expertise can help you optimize your financial plan, avoid common pitfalls, and achieve your goals faster.

Benefits of Consulting a Personal Financial Advisor

- Customized Financial Plans: Advisors create plans that align with your unique needs and goals.

- Expert Investment Advice: They help you choose investments that match your risk tolerance and financial objectives.

- Debt Management: Advisors offer strategies to pay off debt efficiently and avoid financial strain.

- Tax Planning: They guide you on tax-efficient investment strategies, maximizing your savings.

- Retirement Planning: Personal financial advisors ensure you’re on track for a secure retirement by reviewing your current savings and plans.

Key Components of Personal Finance

To manage your finances effectively, focus on these five pillars:

1. Budgeting

Budgeting involves tracking income and expenses to allocate funds wisely. Popular budgeting methods include:

- The 50/30/20 Rule (50% needs, 30% wants, 20% savings)

- Zero-based budgeting (allocating every dollar to a specific purpose)

2. Saving

Setting aside money for short-term goals, such as a vacation or emergency fund, ensures financial stability.

3. Investing

Investments grow your wealth over time. Options include:

- Stocks

- Bonds

- Mutual Funds

- Real Estate

4. Debt Management

Understanding good vs. bad debt and managing credit wisely are essential to financial health.

5. Insurance and Protection

Health, life, and property insurance protect you and your assets from unexpected losses.

How to Improve Your Personal Finance Skills

1. Set Clear Financial Goals

Define short-term and long-term objectives, such as saving for a car or planning for retirement.

2. Track Spending Habits

Use tools like budgeting apps to monitor your spending patterns.

3. Create an Emergency Fund

Aim to save at least three to six months’ worth of living expenses.

4. Diversify Investments

Avoid putting all your money into one investment. Diversify to spread risk and increase returns.

5. Seek Professional Advice

Working with a personal financial advisor can simplify complex financial decisions and improve your outcomes.

Conclusion

Personal finance is the foundation of financial independence and security. By understanding its components and significance, you can make informed decisions, achieve your goals, and prepare for the future. Whether you’re managing a tight budget or planning for retirement, consulting a personal financial advisor can provide invaluable guidance.

FAQs

1. What is personal finance?

Personal finance refers to managing your money, including budgeting, saving, investing, and planning for future financial goals.

2. Why is personal finance important?

It helps you achieve financial goals, prepare for emergencies, reduce debt, and secure your retirement.

3. How can a personal financial advisor help me?

A personal financial advisor provides customized financial plans, investment advice, and strategies for debt and tax management.

4. What are the key components of personal finance?

The main components are budgeting, saving, investing, debt management, and insurance.

5. How do I start managing my personal finances?

Begin by setting financial goals, creating a budget, tracking expenses, building an emergency fund, and seeking professional advice if needed.