Introduction:

We all fall short in one area or another; finance is that one common area for all of us. Now this is coming to an end, and everyone can be smart to achieve financial expertise.

Finance is often considered an area of expertise for the rich; however, finance has a more important role to play in the lives of the not-so-rich too. Hence, when it comes to prioritising finances, they should be prioritised first among all the other work.

Given the circumstances and busy lives, we often get short on time to manage our finances; hence, there should be methods, strategies, and platforms to do this and ease our financial lifestyle.

Step 1: Google

You can improve your chances of better managing your finances by using Google. Yes, you read it right. Google provides so much information through search engines and free tools like Google Sheets, which can be very handy to manage your finances.

Step 2: Old school methods

You can consult your family and friends for better management of your finances; however, this step is prone to personal biases, and people may not tell you the whole truth, which may hamper your speed of making decisions.

Step 3: Platforms

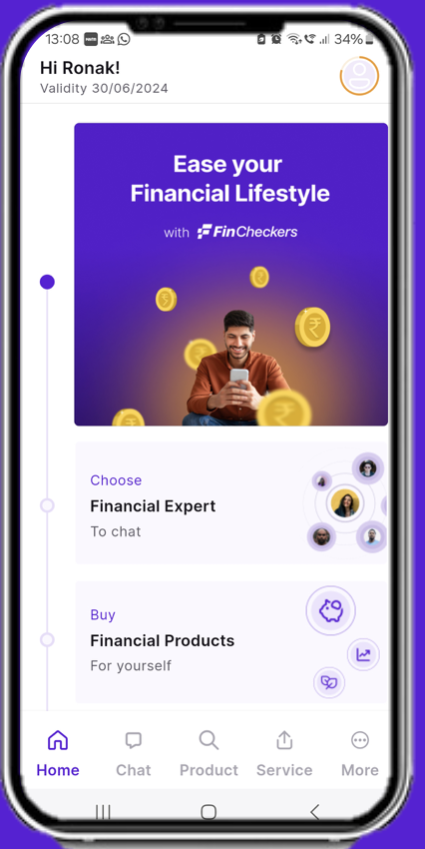

FinCheckers is one of the platforms that can enormously ease your financial lifestyle. This company has a vision to make financial well-being easy, accessible, and executable for all globally. This platform is a clear winner among all use case-specific platforms because it does not ask for any personal information from you and is still able to help you out of financial difficulties. Install this app here. FinCheckers

Conclusion:

Finances require your highest priority among all the tasks in hand. Google and traditional methods are effective, but a platform that efficiently manages and accesses them is the clear winner.