Introduction:

Our lives are full of responsibilities, and the complexity of our finances makes them more complex. These five easy steps can make a significant improvement in your financial lifestyle.

We as individuals have various responsibilities, like family goals, health goals, education goals, professional goals, and much more. In this day-to-day full-packed routine, we all stumble to balance all of them. The irony is that every goal is an important goal. Otherwise, we all feel FOMO in our own way.

Let’s understand what a financial lifestyle is. Financial lifestyles are not limited to financial planning. Moreover, it is the umbrella of every activity that you do in order to take care of your finances. For example, executing financial products, clearing doubts from financial experts, servicing financial products, using some tools to better manage your finances, or joining a community to enhance your financial knowledge. In the process, financial planning is only one part of it.

5 easy steps to ease your financial lifestyle

1. Enhance your financial literacy.

The best way to solve a problem is to go head-on and enhance financial literacy by reading about financial markets, financial products, financial institutions, and the basics of financial goal-setting. One must know about the financial regulators and investment vehicles available, like mutual funds, savings accounts, current accounts, health insurance, life insurance, and much more.

You can start with financial goal-setting and then move to each element gradually.

2. Plan regularly.

Financial lifestyle has something to do with financial planning. You can plan out your days, weeks, months, quarters, and years in order to manage your money. You can start with SMART goals. SMART is Specific, Measurable, Achievable, Relevant, and Time-Based Goals.

You can start by keeping your financial details handy.

3. Keep your financial details handy.

Financial details are very critical details, which one needs handy in order to ease the financial lifestyle. One should keep details of credit cards, savings accounts, debit cards, investments, digital application details, retirement accounts, insurance details, etc. handy.

You can start by monitoring one of the financial details.

4. Monitor your finances.

An individual has almost 10 financial products active at any given time. One should start with one product, let’s say income. Monitor your income crediting accounts to start with and extend that to expense instruments like credit cards, debit cards, loans, etc.

You can start by using digital platforms to do that.

5. Use digital platforms.

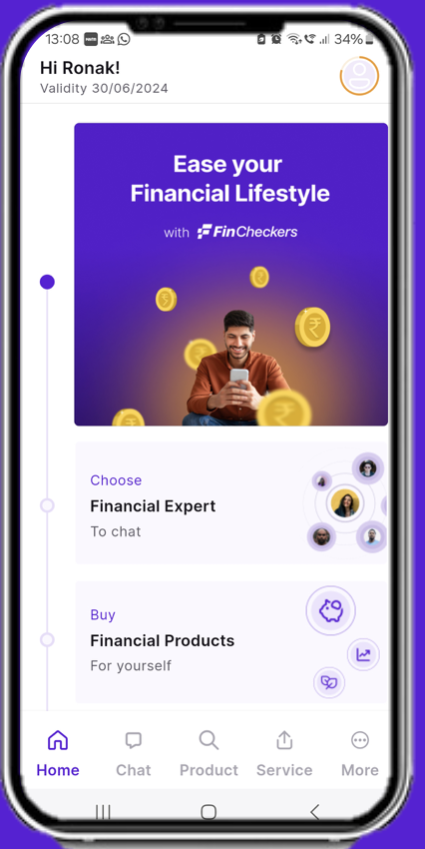

There are various digital platforms on the market to help you with your finances; however, one of the holistic platforms that is available to ease your financial lifestyle is the FinCheckers Get App. They provide access to experts to clear all your doubts related to financials, they also provide access to buy financial products, Financial services, tools, and communities to better enable you and ease the complete financial lifestyle.

Conclusion:

To ease your financial lifestyle effectively, an individual can use digital platforms or enhance financial literacy, including steps like setting up financial goals, monitoring finances, and much more.